Mobile Payments in UK - 2012

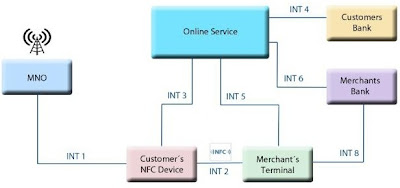

Mobile Payments project by Payments Council UK has progressed towards making payments using just a mobile phone number possible for everyone. The Payment Council is working on the database that links mobile numbers to account details. By doing this, an individual can receive and make payments on the go via Mobile phones regardless of who you Bank with. The database will be available to UK banks and building societies before the end of 2012. Customers will register for the service through their own bank, with no need to share their details with a third party. The final service will be safe, secure and simple to use – offering an easy way to pay a friend back for dinner, or pay a window cleaner or other tradesman. The work to develop account-to-account mobile payments is going ahead in the context of a wider review of the landscape in mobile payment initiatives, including developments in contactless payments (also known as Near Field Communication, or NFC) and banking ‘app